Financial education in Washington public schools inadequate, but on its way up

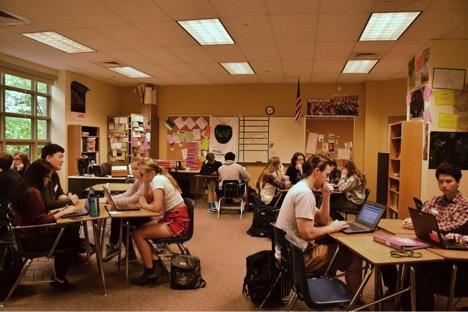

Student's in Carol Faust's "Business in a Global Economy" class, the final class in the Academy of Finance series, at Ballard High School work on their final project on May 25, 2016. Students from the Foster School of Business at UW came in to help the students with their project.

Wed, 06/22/2016

By Carly Knight

When researchers tested college students on their knowledge of personal-finance in 2013, the result was jarring: the average grade was a D.

The personal-finance survey was conducted at Western Washington University, and did not have unusual results. It made it clear that financial education is among the most overlooked things students need to learn.

“Financial literacy is having a much more dramatic effect on students immediately after high school,” said Randy Dorn, Washington state superintendent of public schools. “Whether it’s moving out and doing a lease agreement, buying a car…being inundated with credit card options and interest rates…All those things are financial decisions that students should have more of an education on.”

In May 2015, the Washington Legislature passed a bill that requires the National Jump$tart Standards for Personal Finance to be integrated into existing curriculum in Washington public schools. This means that students may learn about finance in their math class, social studies class, or other required classes.

The Financial Education Public-Private Partnership (FEPPP), established in 2004, is responsible for getting financial education into Washington schools, and does so by conducting financial-educator trainings.

The introductory training is two days long. On the first day, teachers are given information about personal-finance. On the second, teachers are given curriculum they can implement in their classrooms.

Pamela Whalley, the FEPPP Education Chair, said teachers who go to the training usually ask for more information afterward, and that post surveys showed teachers who attended the conference were, in fact, using the material in their classrooms.

Washington isn’t one of the 17 states that currently require high school students to take a course in financial education, but Dorn said there is a reason for that: there simply isn’t room for it amid all the other graduation requirements.

Additionally, Whalley warned that a high school financial-education class wouldn’t be sufficient on its own.

“We train teachers K-12. And there’s a reason for that,” Whalley said. She said that waiting until high school to teach personal-finance would be waiting much too late.

However, both Dorn and Whalley added that they would be in favor of students taking a financial-education class in high school if possible.

Despite the absence of a mandate for students to take a class completely dedicated to financial education, there are currently some options available in Seattle Public Schools for students who want to learn more about finance.

A course titled Independent Living is offered at seven Seattle high schools. The class isn’t specifically centered on finance, but focuses on teaching students how to live on their own after graduation.

According to public records, however, only 401 students enrolled in the class in the 2015-2016 school year—less than 3 percent of the 13,913 high school students enrolled in Seattle Public Schools as of May 2, 2016.

For students who attend Franklin, Chief Sealth, or Ballard High School, a more advanced option is available. These schools host an Academy of Finance through the National Academy Foundation (NAF), a two- or three-year program that students must apply to as freshmen or sophomores.

The Academy of Finance requires students to take a minimum of four courses—starting with personal-finance, where they learn about stocks, banking, credit, investments and financial plans. Students also do a semester long project called “My Life at 25,” where they plan out their potential career, salary, debt and investments.

“It’s amazing how realistic the kids are,” said Seattle public schools Academy Coordinator Joanne Patrick. “Because by doing the project they realize they have to change some of their budget plans because they didn’t realize how much housing would cost.”

The Academy of Finance is designed for students who want to pursue a career in finance or business, but for those who don’t the academy is still beneficial.

“There are quite a few people…who don’t end up going into the business field, and I definitely think there’s things to learn from the class,” said Alvin Benevides, an Academy of Finance alumnus.

“Learning about personal-finance is applicable to pretty much anyone.”

So what’s next for financial education in public schools?

The FEPPP will continue its educator trainings. Whalley said that she hopes they can release K-12 personal-finance standards in September, which will give teachers guidance on what materials should be taught at each age.

Whalley also said her organization is hoping to replicate a project it did with the Aberdeen School District in which trainers prepared all of the teachers to lead the students through personal-finance, K-12.

“I don’t think we’re doing what we need to do,” Whalley said. “I think we’re taking steps to get there.”